The Australian Energy Market Operator’s (AEMO) draft 2020 integrated system plan (ISP) provides a roadmap to the energy market for the next two decades.

The report outlines a range of scenarios, but its central forecast predicts a shift from a centralised coal-fired generation system to a “highly diverse portfolio dominated by distributed energy resources and variable renewable electricity”.

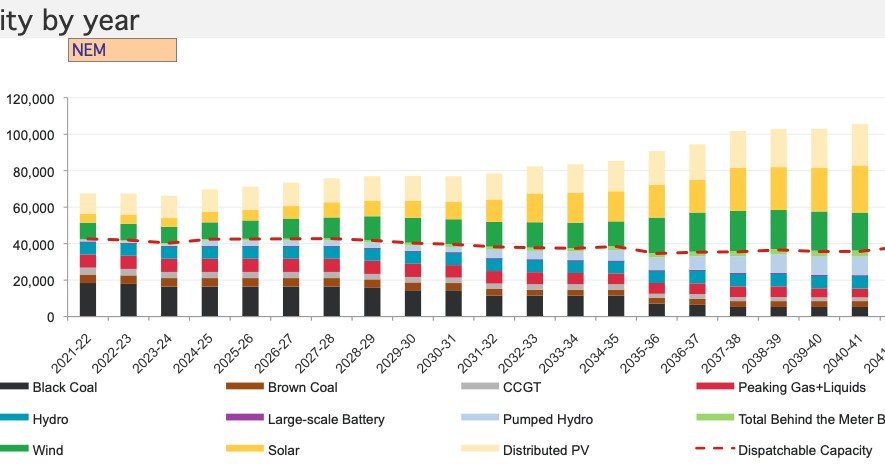

The AEMO’s central scenario predicts a large drop-off of coal capacity, replaced by renewables including around 20GW of wind capacity (pic: AEMO)

The AEMO’s central scenario predicts a large drop-off of coal capacity, replaced by renewables including around 20GW of wind capacity (pic: AEMO)

The AEMO said its modelling showed this shift was the “least-cost-and-regret transition”.

Australia will become increasingly dependent on distributed renewable energy resources, such as roof-top solar, for much of its electricity. This will also need to be supported by local storage and load management.

With more renewables on the grid, the AEMO also forecasts the need for 21GW of dispatchable resources “in the form of utility-scale pumped hydro or battery storage, demand response such as demand-side participation, and distributed batteries participating as virtual power plants”.

As with the AEMO’s 2018 draft ISP, the priority facing Australia’s electricity sector was the need to invest heavily in the transmission network, with several interconnection projects highlighted (below).

“The Draft 2020 ISP sets out how to build a least-cost system for Australia, but for consumers to receive the full benefit of the plan, important additional work on market design and infrastructure funding options need to be undertaken,” said AEMO CEO Audrey Zibelman.

According to the ISP’s central scenario of optimal development, the AEMO predicted wind capacity in Australia to grow from 8.88GW in 2020-21 to over 20.7GW by 2040.

This would see wind’s share of total generation, including storage capacity, to increase from 14% in 2022 to 29% by 2042.

In the same scenario, coal’s generation will fall from 62.5% of the total in 2022 to 23.2% 20 years later. Coal capacity in Australia could fall from 23GW to less than 9GW.

“We strongly support AEMO’s development path for extensive upgrades to the transmission grid to deliver the infrastructure needed to make the most of our vast clean energy resources, ensure the future stability and security of Australia’s energy system and deliver low-cost energy to consumers,” said Kane Thornton, chief executive of lobby group the Clean Energy Council.

“As we have consistently said, a clear roadmap for transmission development is imperative in order to build investor confidence for new clean energy generation — which is urgently needed to ensure new generation is in place before our ageing coal power plants retire,” Thornton added.

The AEMO plans to finalise the ISP by mid-2020.